Non-profit or LLC?

September 29, 2020

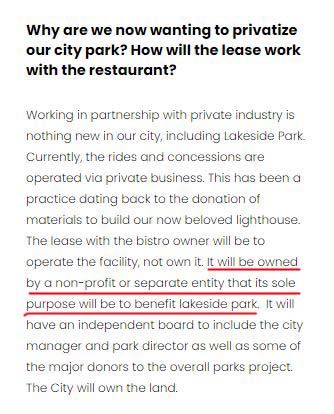

We’ve been told the investors entity that will have the ownership of the restaurant building would be a non-profit. Oops, there was some fine print. In the FAQ on the Lakeside Forward site it does say “non-profit or separate entity.”

Let’s try and figure out what that means by looking at the latest document, the developer’s agreement.

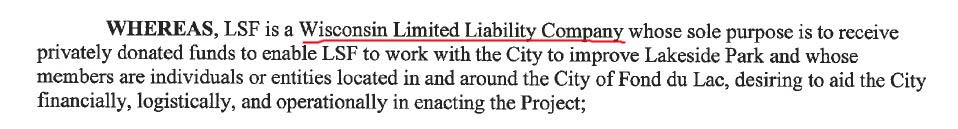

In the developer’s agreement presented to the city council on Sept 23, 2020, Lakeside Forward (LSF) is set up as a Wisconsin Limited Liability Company. According to the Wisconsin Department of Revenue:

Profits and losses of an LLC are allocated among members on the basis of their contributions, unless otherwise

provided for in an operating agreement. Distributions of cash or the assets of an LLC are made to members in

the same manner that profits are allocated, unless the distribution is varied by an operating agreement.

[§§183.0503 and 183.0602, Wis. Stats.]

Lakeside Forward looks like a for profit company. It is not clear how this arrangement provides that there are no profits to the donors. An LLC is the usual structure of a for profit business.

Non-profit entities have requirements that come with their special status. For one, they file a public 990 form every year. There is no such public requirement for a LLC.

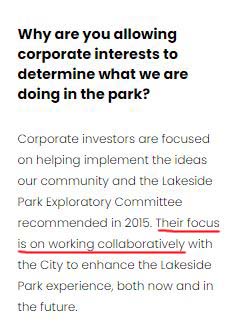

We were also told that the “investors focus is on working collaboratively with the city.” We are at a loss to understand how forcing the city to sign a developer’s agreement before the feasibility study is even done is collaborative. Not to mention surprising the city manager and council with a resolution demanding that it be passed that day with the only reason being that the investors want to “move forward with fundraising.”

We threaten to pull the funds that we promised because we want to raise more funds doesn’t sound very collaborative.